Annuity factor calculator

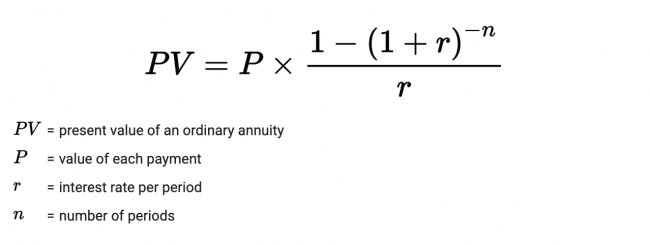

The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. Now in order to understand which of either deal is better ie.

Future Value Factor Of A Single Sum Or Annuity

For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate.

. Factor 2a - 4b a2 - 2ab We usually group the first two and the last two terms. With this service youll be connected to investment professionals in your area who know their stuffand theyre eager to work with you. Approximate Estimated Carat Weight Length Width.

The crediting formulas of indexed annuities generally have some type of limiting factor that is intended to cause interest earnings to be based only on a portion of the change in whatever index it is tied to. Approximate Estimated Carat Weight Length Width Depth 00062 GTF WCF Princess Cut. Number of time periods years t which is n in the formula.

Annuity calculator - Calculate the annuity value of different types of annuities such as immediate annuity deferred annuity fixed annuity etc. As one example an annuity in the form of regular deposits in an interest account would be the sum of the future value of each deposit. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295.

The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Life annuity incomes are guaranteed for life. An annuity is a sum of money paid periodically at regular intervals.

5500 on the current interest rate and then compare it with Rs. 5000 today or Rs. Approximate Estimated Carat Weight Diameter 2 Depth 00061 GTF Oval.

While it can be calculated its easiest to look it up in a table. Just enter your. The future value sum FV.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. If you want to adjust a single lump-sum without compounding try this inflation calculator. The method is very useful for finding the factored form of the four term polynomials.

Calculate the present value of Annuity Due using the following information. The leftover 3 days are forfeited. An annuity factor is a constant value used to calculate the present value of future annuity payments.

This is the present value per dollar received per year for 5 years at 5. 5000 if the present value of Rs. Mutual funds RDs etc.

An annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract regardless of market conditions. Present Value Formula and Calculator. We also provide Present Value of Annuity Due calculator with downloadable excel template.

Most annuity purchasers use guarantee periods to guard against the risk of dying soon after purchasing the annuity. Diamond weight estimation formulae. 4 If youre ready to get started check out SmartVestor.

Guaranteed periods from zero to over 40 years are available. The most important factor that should be considered here is the overall risk Vs. In many circumstances the future value formula is incorporated into other formulas.

5500 after two years we need to calculate a present value of Rs. 5000 then it is better for Company Z to take money after two years otherwise take Rs. This calculator assumes monthly compounding so if you want a different time interval try this compound interest calculator.

You may also look at the following articles to learn more. Other helpful and related calculators include present value calculator and present value of an annuity calculator. FERS employees projected annuity without survivor benefits will be the same.

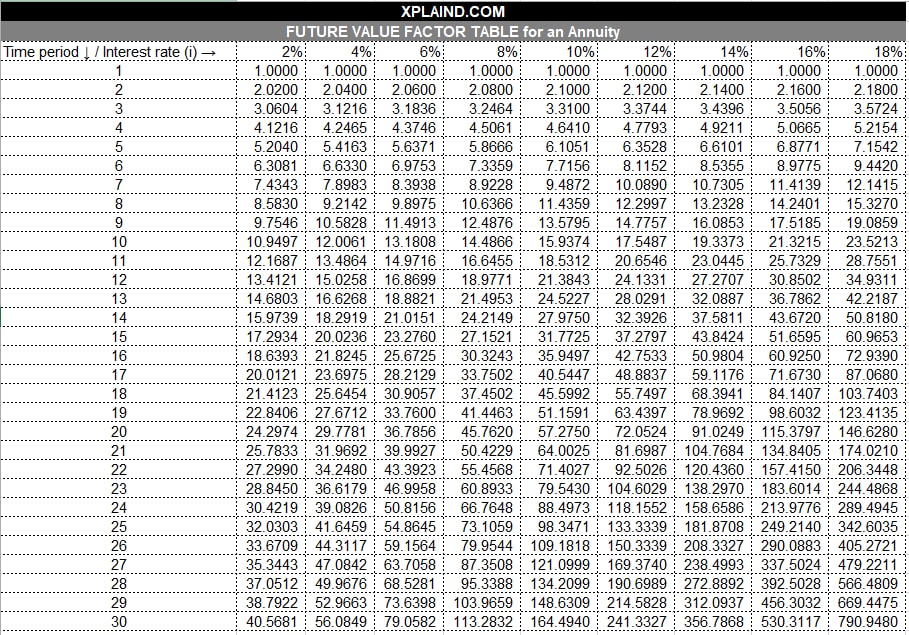

It is a factor that can be used to calculate the future value of a series of annuities. Present value is linear in the amount of payments therefore the present. The CSRS portion of your non-disability benefit will be reduced by an actuarial factor for any CSRS refunded service performed before October 1 1990 if you do not repay the refund before retirement and your annuity commences after December 2 1990.

Judiths SCD for retirement is Nov. 5500 is higher than Rs. The present value is given in actuarial notation by.

2 For purposes of FERS annuity computation 31 years and 9 months is used. Anil Kumar deposits 1000 at the beginning of each year for the period of 3 years and the discount factor of 5. This tool is designed to calculate relatively simple annuity factors for users who are accustomed to making actuarial.

The future cash flows of. Future Value Annuity Formula Derivation. In fact we found that the number one contributing factor to millionaires high net worth is investing in workplace retirement plans.

The Society of Actuaries SOA developed the Annuity Factor Calculator to calculate an annuity factor using user-selected annuity forms mortality tables and projection scales commonly used for defined benefit pension plans in the United States or Canada. Whether Company Z should take Rs. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Input these numbers in the present value calculator for the PV calculation. The Diamond Carat Weight Calculator uses the following weight estimation formulae. FERS employees will be able to use the Projected Annuity Calculator spreadsheet even though it was originally designed for CSRS retirements.

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. Deciding whether money in hand or an annuity payment later is of greater value is complicated due to the time value of money. The future value formula is used in essentially all areas of finance.

FVIFA is the abbreviation of the future value interest factor of an annuity. Present Value Of An Annuity. Her length of service for computing her FERS basic annuity is computed using the above chart.

But you can add a specific guarantee period that ensures the annuity income continues for a period of time even if you die. 1 33 days 1 month and 3 days with 1 month carried over to the month column. Number of Periods Annuity - Present Value PV Calculator Present Value Annuity Factor PVAF Calculator Present Value Growing Annuity PVGA Payment Calculator.

If you retire at age 62 or later with at least 20 years of service a factor of 11 is used rather than 1. Where is the number of terms and is the per period interest rate. Your gender is a key factor in determining your life expectancy which annuity carriers use to calculate your income benefits from an immediate annuity.

Lets assume we have a series of equal present values that we will call payments PMT and are paid once each period for n periods at a constant interest rate iThe future value calculator will calculate FV of the series of payments 1 through n using formula.

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Annuity Table Formulas Calculator Basic Accounting Help

Present Value Annuity Factor Formula With Calculator

How To Calculate The Present Value Of An Annuity Youtube

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Annuity Present Value Pv Formula And Excel Calculator

Present Value Of A Growing Annuity Formula With Calculator

Annuity Formula What Is Annuity Formula Examples

Present Value Of Annuity Formula With Calculator

What Is An Annuity Table And How Do You Use One

Present Value Of An Annuity How To Calculate Examples

Annuity Due Formula Example With Excel Template

Future Value Of An Annuity Formula Example And Excel Template

How To Calculate The Future Value Of An Ordinary Annuity Youtube

How Does A Fixed Annuity Work Due

Annuity Payment Factor Pv Formula With Calculator